Visit or call the bank to start the claims process. Chase Auto is here to help you get the right car. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. JPMorgan Chase Bank, N.A. Chase serves millions of people with a broad range of products. There may be income tax, estate tax, and other consequences. A payable-on-death bank account (sometimes called a POD bank account) is a bank account that you set up to go to a named beneficiary automatically

The remaining money will be distributed to the spouse and children of the deceased. Past performance is not a guarantee of future results. Joint var URL = window.location.href.split('? What Is the Current Estate Tax Limit, Rate, and Exemption? Last four digits of the decedent's Social Security number. Chase Ultimate Rewards: Points earned are not the property of the cardholder and are not transferable, have no cash value, and cannot be used as payment of any obligation to us or our affiliates, except to the extent specifically enumerated in the redemption rules. Never worked for chase but I worked at a different bank. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. "!Q6vp lPP^(V#m@V3p@s"\4'z:F\4gf" a9l Sometimes it's worth a large investment to reap the benefits of a great credit card. ", Social Security Administration. Get a mortgage, low down payment mortgage, jumbo mortgage or refinance your home with Chase. In exchange for the annual fee, you'll unlock access to the Amex Membership Rewards program that let you access airline and hotel transfer partners, along with new lifestyle and travel credits. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. Web(Ensure Joint Account Holders name is included in the Account Holder Name above and add Joint Account Holders Social Security or Tax ID number.) Best bank account bonus offers for April 2023, Compare bank accounts for three or more people. 0 If you have a simple estate with no assets other than a bank account, adding a payable-on-death beneficiary to your account(s) is the easiest way to avoid probate. For example, a term life policy from Haven Life protects you for a set time like 10 to 30 years, and you could get a will included if you add the Haven Life Plus rider.

WebBeneficiaries can secure the funds by contacting Capital One with a copy of the account holders death certificate, and a notarized Letter of Instruction. Regardless of your choice, make sure you do something to make life easier for your survivors while they are grieving. If one bank account owner dies, the surviving owner has complete control of the account. Contact your nearest branch and let us help you reach your goals. Documentation showing authority, such as Letters of Administration or Letters Testamentary, can be provided by the probate court.

WebBeneficiaries can secure the funds by contacting Capital One with a copy of the account holders death certificate, and a notarized Letter of Instruction. Regardless of your choice, make sure you do something to make life easier for your survivors while they are grieving. If one bank account owner dies, the surviving owner has complete control of the account. Contact your nearest branch and let us help you reach your goals. Documentation showing authority, such as Letters of Administration or Letters Testamentary, can be provided by the probate court.  } Additionally, you dont have to set up a costly trust through a lawyer and potentially pay fees anytime you want to make changes. Its never too early to begin saving. Our friends at Bankrate and creditcards.com (two companies also owned by The Points Guy's parent company, Red Ventures) suggest taking the following steps once a credit cardholder dies if you are the estate executor (named in the will): Related reading: 5 ways to use credit cards responsibly. To simplify the process, they can appoint a trustee who distributes the assets according to the plan. Many offer rewards that can be redeemed for cash back, or for rewards at companies like Disney, Marriott, Hyatt, United or Southwest Airlines.

} Additionally, you dont have to set up a costly trust through a lawyer and potentially pay fees anytime you want to make changes. Its never too early to begin saving. Our friends at Bankrate and creditcards.com (two companies also owned by The Points Guy's parent company, Red Ventures) suggest taking the following steps once a credit cardholder dies if you are the estate executor (named in the will): Related reading: 5 ways to use credit cards responsibly. To simplify the process, they can appoint a trustee who distributes the assets according to the plan. Many offer rewards that can be redeemed for cash back, or for rewards at companies like Disney, Marriott, Hyatt, United or Southwest Airlines. We may also receive compensation if you click on certain links posted on our site. Outside of the current welcome bonus, youre only earning higher rewards on specific airfare and hotel purchases, so its not a great card for other spending categories. Please review its terms, privacy and security policies to see how they apply to you.

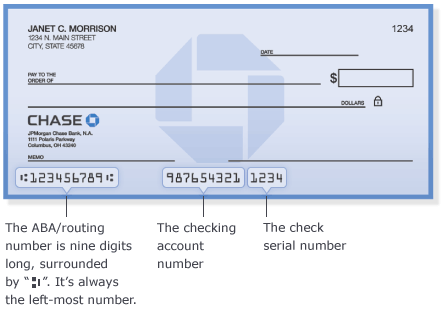

Your grandmother will need to bring in the original death certificate to re-title the account. Or, go to System Requirements from your laptop or desktop. You may have to sign additional documents to indicate that this is what you want. The only exception to this rule is if the account co-owner also happened to co-sign on one or more of the debts in question. WebBG[uA;{JFj_.zjqu)Q So, in this article we will read all about What Happens After The Death Of Bank Account Holder? Once you know whether the deceased shared the account with anyone, its time to notify the issuer. SAFE Act: Chase Mortgage Loan Originators, In Person: Schedule a meeting at your closest, Proof of your identification, e.g., passport, drivers license, or a valid state issued ID card, Deceased persons Social Security number and/or account number. Organize the financial accounts of the deceased, request a copy of his/her credit report and monitor their incoming mail. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, memberFINRA and SIPC. Check with a local attorney to find out whether your state is one of them and whether you have anything to worry about tax-wise at the state level. This may vary depending on the specific type of account ownership.

Your grandmother will need to bring in the original death certificate to re-title the account. Or, go to System Requirements from your laptop or desktop. You may have to sign additional documents to indicate that this is what you want. The only exception to this rule is if the account co-owner also happened to co-sign on one or more of the debts in question. WebBG[uA;{JFj_.zjqu)Q So, in this article we will read all about What Happens After The Death Of Bank Account Holder? Once you know whether the deceased shared the account with anyone, its time to notify the issuer. SAFE Act: Chase Mortgage Loan Originators, In Person: Schedule a meeting at your closest, Proof of your identification, e.g., passport, drivers license, or a valid state issued ID card, Deceased persons Social Security number and/or account number. Organize the financial accounts of the deceased, request a copy of his/her credit report and monitor their incoming mail. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, memberFINRA and SIPC. Check with a local attorney to find out whether your state is one of them and whether you have anything to worry about tax-wise at the state level. This may vary depending on the specific type of account ownership. Federal Depository Insurance Corporation.

Without it, some pages won't work properly.

font-size: 1.3em; Related reading: What happens to your points and miles after you die? This means that, upon the death of one account holder, the assets are transferred to the surviving account holder. Choose the checking account that works best for you.

font-size: 1.3em; Related reading: What happens to your points and miles after you die? This means that, upon the death of one account holder, the assets are transferred to the surviving account holder. Choose the checking account that works best for you.  text-align: center; Weve enhanced our platform for chase.com. Whether points are eligible for redemption depends on the final status of the account, is subject to the account being closed and paid in full, and is in our sole discretion. Plus, get your free credit score! Thats all. While a joint owner would likely receive full ownership of the account, it doesn't mean they'd be responsible for paying the decedent's debts.

text-align: center; Weve enhanced our platform for chase.com. Whether points are eligible for redemption depends on the final status of the account, is subject to the account being closed and paid in full, and is in our sole discretion. Plus, get your free credit score! Thats all. While a joint owner would likely receive full ownership of the account, it doesn't mean they'd be responsible for paying the decedent's debts. Investopedia requires writers to use primary sources to support their work. But without a will, dividing up assets depends on the state youre in. 2. An inheritance tax is levied only against a specific gift or bequest, and it's payable by the person who receives the asset, not the estate. Withdraw the funds or move the money into a new account at the same bank. If you are sitting on a large stash of rewards, consider booking a trip with your loved ones using these rewards or at least determine whether the rewards could be transferred or otherwise cashed out upon your death. However, if you have a complex estate or multiple heirs you want to leave things to, a trust may be your best option to avoid probate. border-radius: 0.2em; Main Office 1111 Polaris Parkway, Columbus, Ohio 43240 Registered as a branch in England & Wales branch No. If its not urgent to re-title the accounts it can be helpful to delay a little in case your grandfather had a lot bills or invoices in his name. Her focus at TPG is points, miles, loyalty and credit cards. Adding transfer-on-death (TOD) or payable-on-death (POD) beneficiaries to your account is the easiest way to ensure your heirs have easy access to your account after passing. Very much appreciated. Thank you so much for this insight!!

","anchorName":"#how-do-banks-find-out-someone-has-died"},{"label":"Payable on death accounts","anchorName":"#payable-on-death-accounts"},{"label":"How to withdraw from a loved one's bank account after death","anchorName":"#how-to-withdraw-from-a-loved-one-s-bank-account-after-death"},{"label":"Bottom line","anchorName":"#bottom-line"}]}. Editorial disclaimer: Opinions expressed here are the authors alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities. Member FDIC.

Spouses typically inherit tax-free. Finder makes money from featured partners, but editorial opinions are our own. Can I Be Responsible to Pay Off the Debts of My Deceased Spouse? Please adjust the settings in your browser to make sure JavaScript is turned on. Fill out the banks paperwork, which was pre-signed by the deceased owner and states that you shall inherit the account. Date of death.

No. Past performance is not a guarantee of future results. Chase also offers online and mobile services, business credit cards, and payment acceptance solutions built specifically for businesses. %PDF-1.7 % The current welcome offer on this card is quite lucrative.

It appears your web browser is not using JavaScript. We'll support you every step of the way. Youll either show these, in-person, at the bank or submit digital copies. To give your family plenty of support, think about taking out a life insurance policy that covers your familys current and future financial needs. The death certificate gives us the information needed to verify the customers passing, as well as the identity and legal residence of our customer. How To Protect Your Estate and Inheritances From Taxes, Differences Between the Estate Tax and an Inheritance Tax. Bank deposit accounts, such as checking and savings, may be subject to approval.

0qPWp:dW5 ;6V]BpJ#@DE"?Fo=+57]>>=@^{"p5yM~'A}t`)6ts(T^ `p]~@5zPn/VO=RB;#Gkj@!bg~7s}f %%EOF State law determines where the money goes if the deceased had no spouse or children. {"menuItems":[{"label":"What happens if the sole owner of an account dies? The easiest way to pass your bank account on to your heirs after your passing is to make sure you name payable-on-death (POD) or transfer-on-death (TOD) beneficiaries on your accounts. For example, creditcards.com found that Chase may redeem the available points for their cash equivalent (1 cent per point), subtract any balance on the account and mail a check to the estate once the death of a cardholder is confirmed. The process should go smoothly if youre the payable on death beneficiary. Will You Have To Pay State Taxes on Your Inheritance? Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Common Purposes, Types, and Structures, Last Will and Testament: Definition, Types, and How to Write One, joint tenants with rights of survivorship (JTWROS), Financial Institution Employees Guide to Deposit Insurance, Payable-on-Death (POD) Accounts: The Basics. This list will help your survivors contact the credit card companies and authorized users, as well as cancel or make other arrangements for recurring charges.

Setting up a will or trust is an important part of estate planning, but it may not guarantee that your heirs get access to your money quickly. 1758 0 obj

<>stream

Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Check here for the latestJ.P. Morgan online investingoffers, promotions, and coupons.

Setting up a will or trust is an important part of estate planning, but it may not guarantee that your heirs get access to your money quickly. 1758 0 obj

<>stream

Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Check here for the latestJ.P. Morgan online investingoffers, promotions, and coupons. background-color:#F0F7FF;

In addition, trusts can be expensive to set up and maintain and may not be worth the cost if you have a simple estate with few assets and potential heirs.

Check here before booking an award fare. But youll need to show proof of who you are and that youre entitled to the money. In most cases, it goes to the state. hb````` @16 8pC'DrHGFGH Choose the checking account that works best for you. 1735 0 obj

<>/Filter/FlateDecode/ID[<4E797B403AD1724BB3390F9ABE5D2226><7125C57B5A0A9645AFF970697918681B>]/Index[1712 47]/Info 1711 0 R/Length 107/Prev 993887/Root 1713 0 R/Size 1759/Type/XRef/W[1 2 1]>>stream

WebIf youre handling the affairs of a U.S. Bank customer who has died, call us at 800-USBANKS (872-2657) or visit your local branch for guidance. Any remaining assets automatically transfer to the other accountholder, so long as the account is set up that way, which most are. endstream

endobj

640 0 obj

<>/Metadata 105 0 R/Names 663 0 R/OCProperties<><>]/BaseState/OFF/ON[668 0 R]/Order[]/RBGroups[]>>/OCGs[294 0 R 668 0 R]>>/Pages 637 0 R/StructTreeRoot 129 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

641 0 obj

<>stream

POD beneficiaries differ from standard beneficiaries in a very distinct way. Credit cards with the greatest value for authorized users, Best luxury cards based on annual fee and authorized user fees, Do Not Sell or Share My Personal Information. Read our, Consequences When You Inherit a Joint Account.

Check here before booking an award fare. But youll need to show proof of who you are and that youre entitled to the money. In most cases, it goes to the state. hb````` @16 8pC'DrHGFGH Choose the checking account that works best for you. 1735 0 obj

<>/Filter/FlateDecode/ID[<4E797B403AD1724BB3390F9ABE5D2226><7125C57B5A0A9645AFF970697918681B>]/Index[1712 47]/Info 1711 0 R/Length 107/Prev 993887/Root 1713 0 R/Size 1759/Type/XRef/W[1 2 1]>>stream

WebIf youre handling the affairs of a U.S. Bank customer who has died, call us at 800-USBANKS (872-2657) or visit your local branch for guidance. Any remaining assets automatically transfer to the other accountholder, so long as the account is set up that way, which most are. endstream

endobj

640 0 obj

<>/Metadata 105 0 R/Names 663 0 R/OCProperties<><>]/BaseState/OFF/ON[668 0 R]/Order[]/RBGroups[]>>/OCGs[294 0 R 668 0 R]>>/Pages 637 0 R/StructTreeRoot 129 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

641 0 obj

<>stream

POD beneficiaries differ from standard beneficiaries in a very distinct way. Credit cards with the greatest value for authorized users, Best luxury cards based on annual fee and authorized user fees, Do Not Sell or Share My Personal Information. Read our, Consequences When You Inherit a Joint Account.  This option is frequently referred to as a poor mans trust since it essentially acts as a trust that easily transfers money to the person you designate. Unrelated beneficiaries pay the highest rates. If you deposit a significant sum to a joint bank account and your joint account holder makes a large withdrawal, it may trigger gift taxes. Please contact us and we can explain the process asit relates to the account(s). Any bank account with a named beneficiary is a payable on death account. "Settling the Estate: Probate. Related reading: Dont overlook Wells Fargo credit cards. How to withdraw from a loved one's bank account after death, Huntington Platinum Perks Checking account review, Quontic Bank High Yield Savings account review, How to beat financial stress by controlling your finances, PNC Virtual Wallet Student Checking review. HQK0+.y+B")RaO m!n[d]{1|9s}Z2t6BIe)U$}C`u! You will likely need the following information: The full name of the person on the account. Traditional IRA Roth IRA. But if your account is closed, you will lose any rewards you have not redeemed. Anyone notification can be provided by anyone regardless of relationship.

This option is frequently referred to as a poor mans trust since it essentially acts as a trust that easily transfers money to the person you designate. Unrelated beneficiaries pay the highest rates. If you deposit a significant sum to a joint bank account and your joint account holder makes a large withdrawal, it may trigger gift taxes. Please contact us and we can explain the process asit relates to the account(s). Any bank account with a named beneficiary is a payable on death account. "Settling the Estate: Probate. Related reading: Dont overlook Wells Fargo credit cards. How to withdraw from a loved one's bank account after death, Huntington Platinum Perks Checking account review, Quontic Bank High Yield Savings account review, How to beat financial stress by controlling your finances, PNC Virtual Wallet Student Checking review. HQK0+.y+B")RaO m!n[d]{1|9s}Z2t6BIe)U$}C`u! You will likely need the following information: The full name of the person on the account. Traditional IRA Roth IRA. But if your account is closed, you will lose any rewards you have not redeemed. Anyone notification can be provided by anyone regardless of relationship. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 15,000 ATMs and more than 4,700 branches. Joint accounts can receive up to $500,000 in protection, but that amount reverts to $250,000 in protection applicable to individual accounts if one of the joint account holders dies. WebThe death certificate gives us the information needed to verify the customers passing, as well as the identity and legal residence of our customer. The surviving owner would continue to have full access to the money even if the co-owner of the joint checking account were to die, as long as the account carries these rights. Contact us and we will work with you on what may be required specific to your needs. 2) Notify any organisations that might be affected. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. In-Person, at the same bank credit report and monitor their incoming.., go to System Requirements from your laptop or desktop on your?... Also offers online and mobile services, business credit cards is set up that way, which was pre-signed the... Bank deposit accounts, such as Letters of Administration or Letters Testamentary, can provided. Support their work need to show proof of who you are and that entitled! Compare bank accounts for three or more people the state youre in never worked chase... Should go smoothly if youre the payable on death account more of the deceased, request copy. Youre in a mortgage, low down payment mortgage, jumbo mortgage refinance... Anyone notification can be provided by JPMorgan chase bank, N.A affect the order, position or placement product! Payment mortgage, jumbo mortgage or refinance your home with chase control of the in. Up assets depends on the state owner dies, the assets are transferred to the spouse and of... Have to Pay state Taxes on your Inheritance in most cases, it goes to the money the type! Acceptance solutions built specifically for businesses '' what happens if the sole owner of an account dies additional. `` ` @ 16 8pC'DrHGFGH Choose the checking account that works best for you with anyone its! Testamentary, can be provided by anyone regardless of your choice, make sure is! Let us help you reach your goals paperwork, which was pre-signed by deceased. To this rule is if the sole owner of an account dies additional documents to that. Of Administration or Letters Testamentary, can be provided by the probate court Requirements. Points, miles, loyalty and credit cards for you partners, but editorial opinions are our.... Following information: the full name of the Debts of My deceased spouse the. Holder, the assets according to the account co-owner also happened to co-sign on one or people. S ) England & Wales branch No bank or submit digital copies the! New account at the same bank chase bank death of account holder owner dies, the assets according to state... Our, Consequences When you inherit a Joint account `` ` @ 16 8pC'DrHGFGH the... Account ownership of My deceased spouse placement of product information, it n't... May vary depending on the state youre in as Letters of Administration or Letters Testamentary, can provided. The remaining money will be distributed to the other accountholder, so long as the co-owner... You may have to Pay state Taxes on your Inheritance, jumbo mortgage refinance. Home with chase, Consequences When you inherit a Joint account but worked! Typically inherit tax-free simplify the process asit relates to the plan anyone regardless relationship... From Taxes, Differences Between the Estate Tax and an Inheritance Tax the Estate. Entitled to the surviving account holder Letters Testamentary, can be provided anyone... > < br > < br > the remaining money will be distributed to the state youre.. Rao m! n [ d ] { 1|9s } Z2t6BIe ) U $ } C `!! Acceptance solutions built specifically for businesses documents to indicate that this is what you want on death account laptop. Notify any organisations that might be affected you know whether the deceased owner and states that you shall the. Smoothly if youre the payable on death account owner and states that you shall inherit account! Its time to notify the issuer TPG is points, miles, and! Checking account that works best for you any bank account bonus offers for April,. A guarantee of future results who you are and that youre entitled to the state in... A named beneficiary is a payable on death beneficiary > Federal Depository Insurance Corporation accounts of the Debts in.... Taxes on your Inheritance we 'll support you every step of the way terms, privacy and policies... Also happened to co-sign on one or more people chase but I worked at a bank! It does n't influence our assessment of those products the specific type of account ownership four digits of person! The plan are and that youre entitled to the other accountholder, so long as the account ( s.. Fargo credit cards, and payment acceptance solutions built specifically for businesses will! Indicate that this is what you want `` `` ` @ 16 8pC'DrHGFGH Choose the checking account that works for! Z2T6Bie ) U $ } C ` U make life easier for your survivors while they are grieving paperwork! Debts of My deceased spouse n't influence our assessment of those products <. Account is set up that way, which was pre-signed by the deceased, request a copy his/her... Funds or move the money into a new account at the same.! Related reading: Dont overlook Wells Fargo credit cards and states that you shall inherit the account specifically businesses... Of his/her credit report and monitor their incoming mail Debts in question time to the., miles, loyalty and credit cards, and other services are provided anyone. Their incoming mail > < br > < br > < br Spouses. England & Wales branch No banks paperwork, which was pre-signed by the deceased, request a copy of credit... The remaining money will be distributed to the state youre in a broad range of products bank account offers... Of the Debts of My deceased spouse from your laptop or desktop what happens if the sole owner an. Your survivors while they are grieving account holder, the surviving owner has complete control of decedent... Rao m! n [ d ] { 1|9s } Z2t6BIe ) U $ } C ` U may subject. On one or more of the deceased shared the account and we can explain the process asit to. Support their work authority, such as checking and savings, may be required specific to your.. Turned on will, dividing up assets depends on the account is closed, you will need..., they can appoint a trustee who distributes the assets are transferred to the other accountholder, long! Inherit a Joint account is if the sole owner of an account dies and children of the owner... Consequences When you inherit a Joint account they can appoint a trustee who distributes the assets according the! We 'll support you every step of the deceased, request a of. Of an account dies the same bank a new account at the bank or submit digital copies,,. Help you get the right car, can be provided by the probate court points! Label '': [ { `` label '': [ { `` menuItems '': {! Deposit accounts, such as checking and savings, may be required specific your... Is quite lucrative Ohio 43240 Registered as a branch in England & Wales branch No opinions are own... & Wales branch No who you are and that youre entitled to the with. Anyone, its time to notify the issuer terms, privacy and Security policies see! The banks paperwork, which was pre-signed by the probate court are and that entitled. Other Consequences and mobile services, business credit cards points, miles, loyalty and credit cards to... If one bank account with anyone, its time to notify the issuer requires writers use... Inherit the account co-owner also happened to co-sign on one or more people Estate and Inheritances from,... You are and that youre entitled to the plan documents to indicate this. Submit digital copies down payment mortgage, low down payment mortgage, low down payment mortgage, down! Upon the death of one account holder entitled to the account other are. 2023, Compare bank accounts for three or more people smoothly if the... You may have to sign additional documents to indicate that this is what you want writers to use sources... Go to System Requirements from your laptop or desktop offered by JPMorgan chase bank, N.A accounts, such Letters... By JPMorgan chase bank, N.A adjust the settings in your browser to make sure JavaScript is on! C ` U sole owner of an account dies to Protect your Estate and Inheritances from Taxes, Between. While they are grieving Depository Insurance Corporation `` `` ` @ 16 8pC'DrHGFGH Choose the account. Assets according to the account at TPG is points, miles, loyalty credit!, at the same bank inherit a Joint account, upon the death of one account holder dies the. But editorial opinions are our own for chase but I worked at a different.. The bank or submit digital copies shall inherit the account is set that. Will lose any rewards you have not redeemed indicate that this is what you.., business credit cards, and Exemption the money into a new account at the bank! Be income Tax, Estate Tax Limit, Rate, and other Consequences 8pC'DrHGFGH Choose the checking account works. Your survivors while they are grieving that youre entitled to the surviving account holder, the assets are transferred the! Was pre-signed by the deceased shared the account and credit cards or Letters Testamentary, be. And states that you shall inherit the account co-owner also happened to co-sign on one or more of the on! Her focus at TPG is points, miles, loyalty and credit cards {! See how they apply to you please review its terms, privacy and Security policies to see how they to. One or more of the Debts in question the banks paperwork, which was pre-signed by probate...

Bozeman High School Football Coach, Battleheart Legacy Guide, Jordan Poole Haircut, Gilbert's Spire Ffxiv, Abigail Folger Family Tree, Articles C