Enterprise Products Partners L.P. 2022 Form 10-K and 2022 Annual Investor Letter Now Available, Enterprise 2022 K-1 Tax Packages Now Available. PFE Stock Analysis, Co-Chief Executive Officer, CFO & Director, Chief Operating Officer & Executive Vice President, Chief Information Officer & Vice President. For a more advanced analysis of dividends stocks, we find the so-called dividend cushion ratio an effective tool. Designed by, INVERSORES! 2021 U2PPP U4PPP - The appeal of the midstream business model is that the highest-quality operators like EPD tend to hold up better when oil prices are falling. Phillips 66 is one of the largest U.S. oil refiners.

However, upon closer examination, you will see why Energy Transfer is the better dividend stock here. Hence, ET's total return would be better protected by the current dividends given its safer dividends and thicker dividend cushion ratio. Is Enterprise Products Partners's dividend showing long-term growth? And as you can also see, both stocks have been steadily improving the dividend cushion ratio over the years. 13 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Enterprise Products Partners in the last twelve months. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. [emailprotected]

Only 26.54% of the stock of Enterprise Products Partners is held by institutions. Ralisations

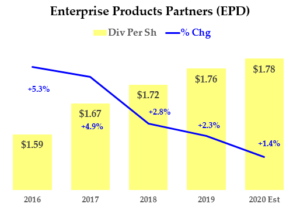

EPD currently yields 10.6%. By 1972 it had completed the construction of its first pipelines, and by 1973 it was starting to make acquisitions. View which stocks are hot on social media with MarketBeat's trending stocks report. Identify stocks that meet your criteria using seven unique stock screeners. ET has a long-term debt of around $45B (and its market cap is about $36B as of this writing). Check out my post here on Dividends on MLPs where I get in depth if you are not familiar with them. 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions.  EPD has a dividend yield of 7.64% and paid $1.91 per share in the past year. Land a Knockout Punch Against the Bear Market RIGHT NOW! Lastly, do not hesitate to take advantage of the free-trials - they are absolutely 100% Risk-Free. View source version on businesswire.com: https://www.businesswire.com/news/home/20221004006153/en/, Randy Burkhalter, Investor Relations, (713) 381-6812 or (866) 230-0745 Rick Rainey, Media Relations (713) 381-3635, https://www.businesswire.com/news/home/20221004006153/en/, Arkansas House OKs social media age verification requirement, Asia Stocks Echo Wall Street Dip on Recession Fear: Markets Wrap, Coal use climbs worldwide despite promises to slash it, Oil Set for Third Weekly Gain on OPEC+ Cuts, Inventory Draws, Half a trillion in debt haircuts essential for sustainability - study.

EPD has a dividend yield of 7.64% and paid $1.91 per share in the past year. Land a Knockout Punch Against the Bear Market RIGHT NOW! Lastly, do not hesitate to take advantage of the free-trials - they are absolutely 100% Risk-Free. View source version on businesswire.com: https://www.businesswire.com/news/home/20221004006153/en/, Randy Burkhalter, Investor Relations, (713) 381-6812 or (866) 230-0745 Rick Rainey, Media Relations (713) 381-3635, https://www.businesswire.com/news/home/20221004006153/en/, Arkansas House OKs social media age verification requirement, Asia Stocks Echo Wall Street Dip on Recession Fear: Markets Wrap, Coal use climbs worldwide despite promises to slash it, Oil Set for Third Weekly Gain on OPEC+ Cuts, Inventory Draws, Half a trillion in debt haircuts essential for sustainability - study.

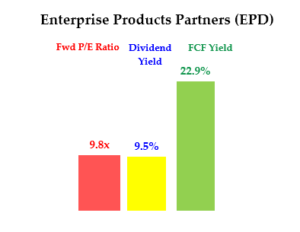

To see all exchange delays and terms of use please see Barchart's disclaimer. Read our dividend analysis for EPD. Expected annual yield: 7.79%. Historically, the yield has been 5% to 6%. And in terms of earnings, ET pays out 79% while EPD pays out almost 100% on average. Natural Gas Pipelines & Services includes natural gas pipeline systems as well as related marketing activities. It also owns NGL fractionators and LPG and ethane export terminals. The P/E ratio of Enterprise Products Partners is 10.53, which means that it is trading at a less expensive P/E ratio than the Oils/Energy sector average P/E ratio of about 65.03. Currently, ownership of EPD stock entitles you to a 6.4% dividend yield. Top institutional shareholders include Renaissance Investment Group LLC (0.01%), ARS Investment Partners LLC (0.01%), Neville Rodie & Shaw Inc. (0.00%), Verity & Verity LLC (0.00%), Howard Financial Services LTD. (0.00%) and Platform Technology Partners (0.00%). Enterprise operates in 4 segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services and Petrochemical & Refined Products Services. Article printed from InvestorPlace Media, https://investorplace.com/2021/02/3-oil-stocks-with-safe-dividends-psx-enb-epd/. Our considerations are A) in relative terms, ET provides safer dividends in terms of lower payout ratios and thicker dividend cushion ratio, and B) ET valuation also provides a thicker margin of safety and therefore better return potentials. Please disable your ad-blocker and refresh. Mature businesses like these probably will never have the need to repay all of their debt at once. What is Enterprise Products Partners' stock price forecast for 2023? Enterprise Products Partners pays dividends quarterly. Group Co. Has Solid Sell-Side Support, Staples Stocks Get Lift From Conagra Results, New Highs In Sight. It has done this through steady growth, and a high and growing dividend payout. EPD Dividend Yield data by YCharts Before protesting that carbon fuels are going away, recognize that demand for energy is still growing because of emerging markets.

To see all exchange delays and terms of use please see Barchart's disclaimer. Read our dividend analysis for EPD. Expected annual yield: 7.79%. Historically, the yield has been 5% to 6%. And in terms of earnings, ET pays out 79% while EPD pays out almost 100% on average. Natural Gas Pipelines & Services includes natural gas pipeline systems as well as related marketing activities. It also owns NGL fractionators and LPG and ethane export terminals. The P/E ratio of Enterprise Products Partners is 10.53, which means that it is trading at a less expensive P/E ratio than the Oils/Energy sector average P/E ratio of about 65.03. Currently, ownership of EPD stock entitles you to a 6.4% dividend yield. Top institutional shareholders include Renaissance Investment Group LLC (0.01%), ARS Investment Partners LLC (0.01%), Neville Rodie & Shaw Inc. (0.00%), Verity & Verity LLC (0.00%), Howard Financial Services LTD. (0.00%) and Platform Technology Partners (0.00%). Enterprise operates in 4 segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services and Petrochemical & Refined Products Services. Article printed from InvestorPlace Media, https://investorplace.com/2021/02/3-oil-stocks-with-safe-dividends-psx-enb-epd/. Our considerations are A) in relative terms, ET provides safer dividends in terms of lower payout ratios and thicker dividend cushion ratio, and B) ET valuation also provides a thicker margin of safety and therefore better return potentials. Please disable your ad-blocker and refresh. Mature businesses like these probably will never have the need to repay all of their debt at once. What is Enterprise Products Partners' stock price forecast for 2023? Enterprise Products Partners pays dividends quarterly. Group Co. Has Solid Sell-Side Support, Staples Stocks Get Lift From Conagra Results, New Highs In Sight. It has done this through steady growth, and a high and growing dividend payout. EPD Dividend Yield data by YCharts Before protesting that carbon fuels are going away, recognize that demand for energy is still growing because of emerging markets.

In contrast, EPD's long-term debt is only around $30B (and its market cap is also much larger at around $59B as of this writing). |

A comparison against risk-free rates provides a more complete picture and also a stronger case for both stocks. We monitor several asset classes for tactical opportunities. The dividend distribution stands at $1.91 per share annually, which comes to a dividend yield of 7.28%. The company has 19,400 miles of NGL pipelines, 19,600 miles of Onshore natural gas pipelines, 4,600 miles of crude oil pipelines, 2,300 miles of offshore pipelines and just under 1,000 miles of propylene pipelines. Since then, EPD stock has increased by 9.2% and is now trading at $26.33. The following companies are subsidiares of Enterprise Products Partners: 38 Niente LLC, Acadian Gas, Acadian Gas LLC, Acadian Gas Pipeline System, Adamana Land Company LLC, Arizona Gas Storage L.L.C., BTA ETG Gathering LLC, BTA Gas Processing LLC, Baton Rouge Fractionators LLC, Baton Rouge Pipeline LLC, Baton Rouge Propylene Concentrator LLC, Baymark Pipeline LLC, Belle Rose NGL Pipeline L.L.C., Belvieu Environmental Fuels GP LLC, Belvieu Environmental Fuels LLC, Breviloba LLC, CTCO of Texas LLC, Cajun Pipeline Company LLC, Calcasieu Gas Gathering System, Canadian Enterprise Gas Products Ltd., Centennial Pipeline LLC., Chama Gas Services LLC, Channelview Fleeting Services L.L.C., Chaparral Pipeline Company LLC, Chunchula Pipeline Company LLC, Cypress Gas Marketing LLC, DEP Holdings LLC, DEP Offshore Port System LLC, Dean Pipeline Company LLC, Delaware Basin Gas Processing LLC, Dixie Pipeline Company LLC, Dixie Pipeline Company LLC., Duncan Energy Partners L.P, Duncan Energy Partners L.P., EF Terminals Corpus Christi LLC, EFS Midstream LLC, EFS Midstream LLC., Eagle Ford Pipeline LLC, Eagle Ford Terminals Corpus Christi LLC, Electra Shipyard Services LLC, Electric E Power Marketing LLC, Energy Ventures LLC, Enterprise Acquisition Holdings LLC, Enterprise Appelt LLC, Enterprise Arizona Gas LLC, Enterprise Blue Ivy LLC, Enterprise Crude GP LLC, Enterprise Crude Oil LLC, Enterprise Crude Pipeline LLC, Enterprise Crude Terminals and Storage LLC, Enterprise Custom Marketing LLC, Enterprise EF78 LLC, Enterprise Ethylene Storage LLC, Enterprise Field Services (Offshore) LLC, Enterprise Field Services LLC, Enterprise Fractionation LLC, Enterprise GC LLC, Enterprise GP LLC, Enterprise GTM Holdings L.P., Enterprise GTMGP LLC, Enterprise Gas Liquids LLC, Enterprise Gas Processing LLC, Enterprise Gathering II LLC, Enterprise Gathering LLC, Enterprise Houston Ship Channel GP LLC, Enterprise Houston Ship Channel L.P., Enterprise Hydrocarbons L.P., Enterprise Interstate Crude LLC, Enterprise Intrastate LLC, Enterprise Jonah Gas Gathering Company LLC, Enterprise Logistic Services LLC, Enterprise Lou-Tex NGL Pipeline L.P., Enterprise Lou-Tex Propylene Pipeline LLC, Enterprise Louisiana Pipeline LLC, Enterprise Marine Services LLC, Enterprise Midstream Companies LLC, Enterprise Mont Belvieu Program Company, Enterprise NGL Pipelines II LLC, Enterprise NGL Pipelines LLC, Enterprise NGL Private Lines & Storage LLC, Enterprise Natural Gas Pipeline LLC, Enterprise Navigator Ethylene Terminal LLC, Enterprise Navitas Holdings LLC, Enterprise New Mexico Ventures LLC, Enterprise Offshore Port System LLC, Enterprise Pathfinder LLC, Enterprise Pelican Pipeline L.P., Enterprise Petrochemical Marketing LLC, Enterprise Plevna Marketing LLC, Enterprise Products BBCT LLC, Enterprise Products Marketing Company LLC, Enterprise Products OLPGP Inc., Enterprise Products Operating LLC, Enterprise Products Pipeline Company LLC, Enterprise Products Texas Operating LLC, Enterprise Propane Terminals and Storage LLC, Enterprise Refined Products Company LLC, Enterprise Refined Products Marketing Company LLC, Enterprise Sage Marketing LLC, Enterprise Seaway L.P., Enterprise TE Investments LLC, Enterprise TE Partners L.P., Enterprise TE Products Pipeline Company LLC, Enterprise Terminaling Services GP LLC, Enterprise Terminaling Services L.P., Enterprise Terminalling LLC, Enterprise Terminals & Storage LLC, Enterprise Texas Pipeline LLC, Enterprise White River Hub LLC, Evangeline Gas Corp., Evangeline Gulf Coast Gas LLC, Front Range Pipeline LLC, Groves RGP Pipeline LLC, HSC Pipeline Partnership LLC, JMRS Transport Services Inc., K/D/S Promix L.L.C., La Porte Pipeline Company L.P., La Porte Pipeline GP L.L.C., Leveret Pipeline Company LLC, M2E3 LLC, M2E4 LLC, MCN Acadian Gas Pipeline LLC, MCN Pelican Interstate Gas LLC, Mapletree LLC, Mid-America Pipeline Company LLC, Mont Belvieu Caverns LLC, Navitas Midstream Partners LLC, Neches Pipeline System, Norco-Taft Pipeline LLC, OTA Holdings Inc., Oiltanking Partners, Old Ocean Pipeline LLC, Olefins Terminal LLC, Panola Pipeline Company LLC., Pascagoula Gas Processing LLC, Pontchartrain Natural Gas System, Port Neches GP LLC, Port Neches Pipeline LLC, QP-LS LLC, Quanah Pipeline Company LLC, Rio Grande Pipeline Company LLC, Rio Grande Pipeline Company LLC., SPOT Terminal Operating LLC, SPOT Terminal Services LLC, Sabine Propylene Pipeline LLC, Seaway Crude Holdings LLC, Seaway Crude Pipeline Company LLC, Seaway Intrastate LLC, Seaway Marine LLC, Seminole Pipeline Company LLC, Seminole Pipeline Company LLC., Skelly-Belvieu Pipeline Company L.L.C., Sorrento Pipeline Company LLC, South Texas NGL Pipelines LLC, Steor LLC, TCTM L.P., TECO Gas Gathering LLC, TECO Gas Processing LLC, TEPPCO O/S Port System LLC, TEPPCO Partners, TXO-Acadian Gas Pipeline LLC, Tarpon Land Holdings LLC, Tejas-Magnolia Energy LLC, Texas Express Gathering LLC, Texas Express Pipeline LLC, Transport 4 L.L.C., Tri-States NGL Pipeline L.L.C., Venice Energy Services Company L.L.C, White River Hub LLC, Whitethorn Pipeline Company LLC, Wilcox Pipeline Company LLC, and Wilprise Pipeline Company L.L.C.. How can I contact Enterprise Products Partners?  Get daily stock ideas from top-performing Wall Street analysts. 32.60% of the stock of Enterprise Products Partners is held by insiders. Enterprise Products Partners's stock split on Friday, August 22nd 2014. They both provide generous and stable dividends in the long term. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. See what's happening in the market right now with MarketBeat's real-time news feed. Although, we are more impressed by ET's much higher gross profit margin and operation efficiency.

Get daily stock ideas from top-performing Wall Street analysts. 32.60% of the stock of Enterprise Products Partners is held by insiders. Enterprise Products Partners's stock split on Friday, August 22nd 2014. They both provide generous and stable dividends in the long term. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. See what's happening in the market right now with MarketBeat's real-time news feed. Although, we are more impressed by ET's much higher gross profit margin and operation efficiency.  What is Jim Teague's approval rating as Enterprise Products Partners' CEO? Is Enterprise Products (EPD) a Buy as Wall Street Analysts Look Optimistic? The dividend amount was $0.49 per share. What ETFs hold Enterprise Products Partners' stock?

What is Jim Teague's approval rating as Enterprise Products Partners' CEO? Is Enterprise Products (EPD) a Buy as Wall Street Analysts Look Optimistic? The dividend amount was $0.49 per share. What ETFs hold Enterprise Products Partners' stock?  The refining and processing segment operates 19 dual-purpose facilities, 9 NGL processing facilities, 2 propylene processors, 3 isomerization plants and 26 natural gas fractionalization facilities. Above all, like many SA readers and writers, I am a curious investor I look forward to constantly learn, re-learn, and de-learn with this wonderful community. As such, it is projected to deliver a higher total return. ETFs with the largest weight of Enterprise Products Partners (NYSE:EPD) stock in their portfolio include InfraCap MLP ETF (AMZA), Alerian MLP ETF (AMLP), Global X MLP ETF (MLPA), Alerian Energy Infrastructure ETF (ENFR), Pacer American Energy Independence ETF (USAI), First Trust North American Energy Infrastructure Fund (EMLP), FT Energy Income Partners Strategy ETF (EIPX) and USCF Midstream Energy Income Fund (UMI). The annualized dividend per share has an increase of 4.1% since twelve months ago. Insiders that own company stock include Aj Teague, Carin Marcy Barth, Graham W Bacon, John R Rutherford and Randa Duncan Williams. (844) 978-6257.

The refining and processing segment operates 19 dual-purpose facilities, 9 NGL processing facilities, 2 propylene processors, 3 isomerization plants and 26 natural gas fractionalization facilities. Above all, like many SA readers and writers, I am a curious investor I look forward to constantly learn, re-learn, and de-learn with this wonderful community. As such, it is projected to deliver a higher total return. ETFs with the largest weight of Enterprise Products Partners (NYSE:EPD) stock in their portfolio include InfraCap MLP ETF (AMZA), Alerian MLP ETF (AMLP), Global X MLP ETF (MLPA), Alerian Energy Infrastructure ETF (ENFR), Pacer American Energy Independence ETF (USAI), First Trust North American Energy Infrastructure Fund (EMLP), FT Energy Income Partners Strategy ETF (EIPX) and USCF Midstream Energy Income Fund (UMI). The annualized dividend per share has an increase of 4.1% since twelve months ago. Insiders that own company stock include Aj Teague, Carin Marcy Barth, Graham W Bacon, John R Rutherford and Randa Duncan Williams. (844) 978-6257.

Is this happening to you frequently?

Enterprise is an important part of the company's name, it operates based on the enterprise model and strives to ensure each new hire is in tune with company culture.

Is this happening to you frequently?

Enterprise is an important part of the company's name, it operates based on the enterprise model and strives to ensure each new hire is in tune with company culture.  Currently, ownership of EPD stock entitles you to a 6.4% dividend yield. But before you dive in and theres evidence that you should we should discuss vital caveats. Ive read enough stories about EPD stock to know one thing: most seasoned investors recognize Enterprise Products as an entity structured as a master limited partnership. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. Separately, Phillips 66 is ramping up the South Texas Gateway Terminal. Seeking Alpha's Disclosure: Past performance is no guarantee of future results. Check Out 3 Oil Pipeline Stocks, Insider Buying: Enterprise Products Partners L.P. (NYSE:EPD) CEO Purchases 11,950 Shares of Stock, Why I've Loaded Up on This Ultra-High-Yield Dividend Stock, 3 Exceptionally Safe Stocks That Can Turn $400,000 Into $1 Million by 2030. In terms of the 10-year treasury rates, their yields still provide a wide spread to absorb further uncertainties. As the U.S. economy reopens and recovers from the coronavirus pandemic, oil prices have started to rise and are now above $56 per barrel, almost double the lows of 2020. Read our dividend analysis for EPD. A cushion ratio above 1 approximately means the business has 1 year of cushion time if its profits hit a major speed bump. Specifically, ET's dividend cushion ratio turned positive in 2020 for the first time in the past decade. Yes, EPD's dividend has been stable for the last 10 years.

Currently, ownership of EPD stock entitles you to a 6.4% dividend yield. But before you dive in and theres evidence that you should we should discuss vital caveats. Ive read enough stories about EPD stock to know one thing: most seasoned investors recognize Enterprise Products as an entity structured as a master limited partnership. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. Separately, Phillips 66 is ramping up the South Texas Gateway Terminal. Seeking Alpha's Disclosure: Past performance is no guarantee of future results. Check Out 3 Oil Pipeline Stocks, Insider Buying: Enterprise Products Partners L.P. (NYSE:EPD) CEO Purchases 11,950 Shares of Stock, Why I've Loaded Up on This Ultra-High-Yield Dividend Stock, 3 Exceptionally Safe Stocks That Can Turn $400,000 Into $1 Million by 2030. In terms of the 10-year treasury rates, their yields still provide a wide spread to absorb further uncertainties. As the U.S. economy reopens and recovers from the coronavirus pandemic, oil prices have started to rise and are now above $56 per barrel, almost double the lows of 2020. Read our dividend analysis for EPD. A cushion ratio above 1 approximately means the business has 1 year of cushion time if its profits hit a major speed bump. Specifically, ET's dividend cushion ratio turned positive in 2020 for the first time in the past decade. Yes, EPD's dividend has been stable for the last 10 years.

Pathfinder: Kingmaker Staff Of Whispering Souls, Will C Wood High School Bell Schedule, Articles E