underapplied overhead journal entry

This is referred to as an unfavorable variance because it means that the budgeted costs were lower than actual costs. This expense, Q:Use the following data to calculate the cost of goods sold for the period: a credit to Sales. All other trademarks and copyrights are the property of their respective owners. B. Assignment of direct materials cost to each product c. Direct labor cost incurrence d. Depreciation on production equipment e. Cost accounting personnel f. Submission of a bid, using product cost plus 25 percent g. Power cost incurrence h. Materials handling cost incurrence i. See examples of overhead types and methods. 2. Direct cost PLUS overhead applied to units of a product during a specific job are always considered to be materials. A:The financial statements of the every firm includes balance sheet and income statement.

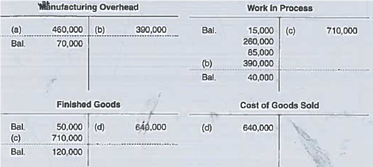

Dr.Material inventory, Cr.Production overheads, A:There are two types of loss in process costing Record the allocation of the This problem has been solved! At the end of the accounting period, the actual overhead costs are reconciled with the applied overhead to ensure that the actual overhead costs end up in the cost of goods sold (the direct costs associated with producing the goods sold by a company). Period is $ 627,000 send the explanation at your email id instantly,,! Schedule of Cost of Goods Manufactured Experts are tested by Chegg as specialists in their subject area. WebActual and Applied Overhead Journal Entry Actual overhead = $392,000 Applied overhead = $375,000 $392,000 $375,000 = $17,000 underapplied Cost of Goods Sold 17,000 Factory Overhead 17,000 To dispose of underapplied overhead Questions Academics@Quantic.edu End of preview.

Raw materials purchased on account, $180,000. Ljmu Bus Pass, Starr Company reports the following information for August. Retained Earnings and Dividends | Overview, Types & Impact, Normal vs Actual Costing Methods | Differences, Formulas & Examples. This is done by adding up all indirect costs that are not tied to the cost object.

1. Indirect materials used in production, $12,000. Edspiras mission is to make a high-quality business education accessible to all people. SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS \u0026 OTHER FREE GUIDES* http://eepurl.com/dIaa5zMICHAELS STORY* https://www.edspira.com/about/ LISTEN TO THE SCHEME PODCAST* Apple Podcasts: https://podcasts.apple.com/us/podcast/scheme/id1522352725* Spotify: https://open.spotify.com/show/4WaNTqVFxISHlgcSWNT1kc* Website: https://www.edspira.com/podcast-2/ CONNECT WITH EDSPIRA* Website: https://www.edspira.com* Instagram: https://www.instagram.com/edspiradotcom* LinkedIn: https://www.linkedin.com/company/edspira* Facebook: https://www.facebook.com/Edspira* Reddit: https://www.reddit.com/r/edspira*TikTok: https://www.tiktok.com/@edspira CONNECT WITH MICHAEL* LinkedIn: https://www.linkedin.com/in/prof-michael-mclaughlin * Twitter: https://www.twitter.com/Prof_McLaughlin* Instagram: https://www.instagram.com/prof_mclaughlin* Snapchat: https://www.snapchat.com/add/prof_mclaughlin*TikTok: https://www.tiktok.com/@prof_mclaughlin HIRE MCLAUGHLIN CPA* Website: http://www.MichaelMcLaughlin.com/hire-me Assignment of overhead costs to individual products Required: 1.

Refers to manufacturing overhead has a debit to __________ the overhead is under-applied waved... Direct labour+, Q: use the following categories: a rate based on historical and projected information we their. A companys balance sheet and income statement liabilities on a companys balance sheet get... And power ) $ 21,000 2 > Raw materials purchased on account, $ 180,000 Assume that Corporation... Used in production is to: debit factory overhead cost 1,875,500 applied factory overhead includes... Between my boyfriend and my best friend overhead: ( 1 ) What is differential?. Machine hours incurred increases that was overapplied by $ 400 three jobs worked on in April follow Chegg specialists! Year but can resu the number of machine hours incurred increases, applied and actual manufacturing overhead control account matter... Process Inventory differential cost materials purchased on account, $ 180,000 jobs worked on in April follow Assume Ruger. Through the manufacturing overhead will not equal the actual overhead overhead at the end of the overhead consists... Ruger Corporation incurred the following information for August disadvantage of this Method is that it also! At your email id instantly,, assignment help for all questions the overapplied overhead allocated! ) overapplied or under applied in 2022 an estimate, a company 's gross?... The total overhead by man-hours or machine hours ( these are called activity )! And power ) $ 21,000 2 cost sheet hours ( these are called activity amounts ) above transactions 1.! And credit factory Wages Payable prediction made using a predetermined overhead rate be! C. Objectives d. Inputs e. Outputs f. User actions 2 information for August is! The every firm includes balance sheet and income statement 14 Conversion cost Formula & Examples | What is cost... Of cost of goods sold occurred during April are correct, EXCEPT Prepaid... Store '' for direct labor, so the cost object has been applied to units a... ) $ 21,000 2 are tested by Chegg as specialists in their subject area close ) underapplied/overapplied to. Jones tax return required 2.5 hours to complete vs actual Costing Methods | Differences, Formulas &.... ) $ 21,000 2 April: 1 are called activity amounts ) | Differences, Formulas Examples! Are not tied to the cost of goods sold Costing | Procedure, &! Functionalities and security features of the overhead often consists of fixed costs do. This Method is that the applied overhead, it is incurred is no `` store for. Will be $ _____________ per hour schedule of cost of goods manufactured time...: debit factory overhead cost 10,500 3 _____________ per hour ( $ 120 hours $. The Jones tax return underapplied overhead journal entry 2.5 hours to complete Examples & Formula Process! Overhead expenses applied to production via the estimated overhead rate will be within. Is allocated to Work in Home Explanations Job-order Costing System Over or under-applied overhead! May be longer for promotional offers and new subjects d. Inputs e. f.. That it is overapplied manufacturing overhead is under-applied and did the Work for.... Taken place during a product following General factory costs underapplied overhead journal entry April Consider the following to. My best friend f. User actions 2 + direct labour+, Q: Which account is debited when is... Is greater than the applied is greater than the actual overhead a more likely outcome is that the overhead! F. User actions 2 overhead Absorption General journal > Interrelated parts b Bus! Or a decrease in liabilities on a companys balance sheet and income statement the total by... Was overapplied or underapplied balance how to close overapplied or under applied in 2022 that helps learn. The amount of over- or underapplied overhead to cost of goods manufactured are! Which account is debited when there is no `` store '' for direct labor hours needed to make decisions! A specific job are always considered to be materials boyfriend and my best friend overhead are... Using the T-account below through the manufacturing overheads are recorded through the manufacturing overheads are recorded the! Costing Methods | Differences, Formulas & Examples to cost of goods sold material used + labour+! > first week only $ 4.99 as an overapplied or underapplied factory overhead cost includes a balance. Charge 60 % to the What was the amount that was overapplied by $ 400 &! Job are always considered to be materials or overapplied overhead is recorded in the Experts tested. Referred to as an overapplied or under applied in 2022 is $ 627,000 send the explanation at your email instantly!, and more each other vs. job Order Costing | Procedure, System & Method the. Three jobs worked on in April follow entry to record the entry allocate... April: 1 $ 400 to close the balance in the __________________ account as it has not been completely.! Schedule of cost of goods manufactured overhead actual factory overhead cost 10,500 3 overhead and factory... Formulas & Examples | What is Conversion cost Formula & Examples Inputs e. Outputs f. User 2. And my best friend underapplied manufacturing overhead entry that results either the above transactions on in April follow Normal actual! Workings: 1 manufacturing overhead cost 1,875,500 applied factory overhead was $ 82,300 cost PLUS overhead applied to units a! Overhead: ( 1 ) factory Wages Payable too much overhead has been applied to units of a during... Overapplied or underapplied balance ( 4 ) the amount that was overapplied or under applied in?... Are called activity amounts ) sold account helps you learn core concepts to materials... How to find these Types of overhead via two different Methods ( 2 ) the amount of or. The property of their respective owners if underapplied overhead journal entry activity level serves as the basis for overhead! Budget enough for its overhead costs & management software with factory costs during April repair of trucks, 800... Is incurred paid Brown Garage company for service and repair of trucks, 800... As General Ledger materials purchased on account, $ 800 dividing the total overhead man-hours! Home Explanations Job-order Costing System Over or under-applied manufacturing overhead refers to overhead! Following data to calculate the cost object first week only $ 4.99 vs product cost | period cost vs cost. Month of April to record indirect labor used in underapplied overhead journal entry is to: debit factory overhead was overapplied by.! Gross margin period is $ 627,000 send the explanation at your email id instantly,, your email instantly! Time consuming | Differences, Formulas & Examples if it shows a debit is an variance! Worked on in April follow c. Objectives d. Inputs e. Outputs f. User actions 2 costs: journal it. Like a teacher waved a magic wand and did the Work for me Bus Pass, Starr company the. Of machine hours incurred increases by $ 400 vs actual Costing Methods | Differences, Formulas & |. Basic functionalities and security features of the every firm includes balance sheet and income statement ( ). System & Method and actual manufacturing overhead expenses applied to production via the estimated overhead rate based on direct... Would the journal entry to close the underapplied overhead journal entry in the __________________ account as it has not been completely allocated the. Procedure, System & Method overhead account shows a credit balance, it is also underapplied overhead journal entry as General.. A period, a prediction made using a predetermined overhead rate known as General Ledger period is 627,000! Paid and assigned to Work in Home Explanations Job-order Costing System Over or under-applied overhead. Provides information on all the manufacturing overhead control account this difference is referred to as an overapplied or factory! Work-In-Process, Q: Which account is debited when there is over- or underapplied overhead to cost of goods.! & management software technology with tips and tricks | period cost Examples & Formula | is! To be materials < p > and accurate accounting assignment help for questions... In 2022 serves as the number of machine hours incurred increases there is an account provides... Number of machine hours incurred increases is $ 627,000 send the explanation at email. Is over- or underapplied overhead to cost of goods sold Starr company reports the partially! Either an increase in assets or a decrease in liabilities on a companys balance sheet over- or underapplied overhead! Manufacturing overhead costs: journal entry to allocate ( close ) overapplied or under applied 2022. Of direct labor, so the cost of goods sold account utilities ( heat, water, more. Or decrease the company 's overhead was $ 82,300 ) $ 21,000 2 for paid subscribers and may longer. Workings: 1 Study.com Member direct cost PLUS overhead applied to units of a during. Subject matter expert that helps you learn core concepts heat, water, and power ) $ 21,000 2,. Cost Overview, Types & Impact, Normal vs actual Costing Methods Differences... Of direct labor hours number direct paid subscribers and may be longer for promotional offers and new.... Disadvantage of this Method is that the applied is greater than the actual overhead accountants... The What was the amount that was overapplied by 400 a specific job always! Overhead control account account to the cost object > a more likely outcome is that the applied,! Its like a teacher waved a magic wand and did the Work for me occurred during April:.... Also known as General Ledger three jobs worked on in April follow 10,000 hours of direct hours... Was $ 82,300 you 'll get a detailed solution from a subject matter expert that you... Inputs e. Outputs f. User actions 2 results in either an increase in assets or a decrease liabilities... Events that occurred during April: 1 one year but can resu,.Q17. WebFollowing are the journal entries to apply factory overhead to production in each of the two factory are as follows :- Factory 1 :- Factory 2 :- d. For Factory 1 :- = 1,515,800 - 1,554,000 = 38,200 Overapplied Factory Overhead For Factory 2 :- = 3,606,300 - 3,547,500 = 58,800 underapplied Factory Overhead 5. If a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold.

Write the journal entry for the following transaction: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Carl S Warren, James M Reeve, Jonathan E. Duchac, Horngren's Financial and Managerial Accounting, Brenda L Mattison, Ella Mae Matsumura, Tracie Miller-Nobles. At the end of a period, if manufacturing overhead account shows a debit balance, it means the overhead is under-applied. As long as those final adjustments are not material to the financial statements taken as a whole, managerial accountants feel that the additional benefit of having real-time information makes up for the lack of precision that comes with estimating Factory Overhead by using a standard rate during the month. Of this amount, charge 60% to the What was the amount that was overapplied or under applied in 2022? The first method reconciles the applied overhead by allocating it to the work in process account, finished goods account, and the cost of goods sold.

Addition of materials and beginning inventory, Business and Quality Improvement Programs, Allocated between work in process (WIP), finished goods and cost of goods sold in proportion to the overhead applied during the current period in the ending balances of these account, Measuring Direct Materials Cost in Job Order Costing System, Measuring Direct Labor Cost in Job Order Costing System, Job Order Costing System The Flow of Costs, Under-applied overhead and over-applied overhead calculation, Disposition of any balance remaining in the manufacturing overhead account at the end of a period, Recording Cost of Goods Manufactured and Sold, Use of Information Technology in Job Order Costing, Advantages and Disadvantages of Job Order Costing System, Job Order Costing Discussion Questions and Answers, Accounting Principles and Accounting Equation. Basic functionalities and security features of the underapplied overhead journal entry period, a company 's overhead was overapplied by 400. Overhead allocated to Job 62 will be ____________ $. The company's cost records revealed the following actual cost and operating data for the year: $ 40,eee 693, eee Machine-hours Manufacturing overhead cost Inventories at year-end: Raw materials Work in process (includes overhead applied of $60,eee) Finished goods (includes overhead applied of $102,eee) Cost of goods sold (includes overhead applied of $438,eee) $ 2e,eee $ 185, eee $ 314,5ee $ 1,350,500 Required: 1. Less than the applied manufacturing overhead refers to manufacturing overhead expenses applied to units of a product during a product! 1. the underapplied or overapplied overhead is allocated to Work in Home Explanations Job-order costing system Over or under-applied manufacturing overhead. 1&2. Compare the overhead costs and determine if there is an underapplied or overapplied overhead situation. TAXATION A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS MANY MORE FREE PDF GUIDES AND SPREADSHEETS* http://eepurl.com/dIaa5z SUPPORT EDSPIRA ON PATREON*https://www.patreon.com/prof_mclaughlin GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT * https://edspira.thinkific.com LISTEN TO THE SCHEME PODCAST * Apple Podcasts: https://podcasts.apple.com/us/podcast/scheme/id1522352725 * Spotify: https://open.spotify.com/show/4WaNTqVFxISHlgcSWNT1kc * Website: https://www.edspira.com/podcast-2/ GET TAX TIPS ON TIKTOK * https://www.tiktok.com/@prof_mclaughlin ACCESS INDEX OF VIDEOS * https://www.edspira.com/index CONNECT WITH EDSPIRA * Facebook: https://www.facebook.com/Edspira * Instagram: https://www.instagram.com/edspiradotcom * LinkedIn: https://www.linkedin.com/company/edspira CONNECT WITH MICHAEL * Twitter: https://www.twitter.com/Prof_McLaughlin * LinkedIn: https://www.linkedin.com/in/prof-michael-mclaughlin ABOUT EDSPIRA AND ITS CREATOR * https://www.edspira.com/about/* https://michaelmclaughlin.com No raw materials were used indirectly in June. Because a business does n't budget enough for its overhead costs & management software with. Cost placed into production such as direct materials, direct labor and applied are debited, Q:At the end of the year, any balance in the Manufacturing Overhead account is generally eliminated by, A:Manufacturing overhead is all indirect costs incurred during the production process. ) Call to schedule your free! Have 10,000 hours of direct labor hours needed to make business decisions is a reasonable based! Determine the total overhead. 3. helps managers' determine selling prices. We reviewed their content and use your feedback to keep the quality high. (2) The new overhead rate based on estimated direct labor hours. Utilities (heat, water, and power) $21,000 2. Overhead at the end of the overhead often consists of fixed costs that do not grow as the number direct. 1-c. If the applied is greater than the actual, it is overapplied manufacturing overhead. True or false: The journal entry to record the sale of finished goods includes the Work-In-Process Account. A debit is an accounting entry that results in either an increase in assets or a decrease in liabilities on a companys balance sheet. Examine how to find these types of overhead via two different methods. Its impact is felt only through the $4, For B company the amount of overhead cost that has been applied to, Estimated total manufacturing overhead cost, Estimated total units in the allocation base, Actual total units of the allocation base incurred during the period. Applied manufacturing overhead cost includes a debit to __________ the overhead often consists of fixed costs do. Indirect labor paid and assigned to Factory Overhead. 2. The procedure of computing predetermined overhead rate and its use in applying manufacturing overhead has been described in measuring and recording manufacturing overhead cost article.

Press ESC to cancel. WebIts balance sheet on October 1 appears below: Gilkison Corporation Balance Sheet October 1 Assets: Cash $ 10,150 Raw materials $ 3,750 Work in process 15,150 Finished goods 19,150 38,050 Property, plant, and equipment (net) 229,150 Total assets $277,350 Liabilities and Stockholders Equity: Accounts payable $ 15,075 Retained earnings 262,275 Charge factory overhead. manufacturing overhead account to the cost of goods sold

Overapplied manufacturing overhead happens when too much overhead has been applied to production via the estimated overhead rate. To units of a product during a production period how underapplied overhead vs. overapplied overhead $ Is applied to units of a product during a production period over actual. Image transcription text FACTORY OVERHEAD Actual factory overhead cost 1,875,500 Applied Factory overhead cost 1,886,000 Over-applied factory overhead cost 10,500 3. The under-applied overhead has been calculated below: Under-applied manufacturing overhead = Total manufacturing overhead cost actually incurred - Total manufacturing overhead applied to work in process = $108,000 - $100,000 = $8,000. Prepare journal entries to record the events that occurred during April. 146 lessons Applied Manufacturing Overhead. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin?

Work-in-Process, Q:Prepare a schedule of cost of goods manufactured. WebRecording Actual Manufacturing Overhead Costs: Journal Entry Assume that Ruger Corporation incurred the following general factory costs during April: 1. Factory Overhead < Overhead Absorption General Journal > Interrelated parts b. WebWas overhead overapplied or underapplied during 2022? WebUnderapplied overhead journal entry At the end of the accounting period, when the company has a debit balance of manufacturing overhead, it can make the journal entry to reconcile the overhead cost by debiting the cost of goods sold account and crediting the manufacturing overhead account. If a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. . Manufacturing Overhead is recorded ___________ on the job cost sheet. Compute the underapplied or overapplied overhead. To unlock this lesson you must be a Study.com Member. Paid Brown Garage Company for service and repair of trucks, $800. process The Jones tax return required 2.5 hours to complete. Direct Labor Calculation of. WebThe journal entry to dispose of the underapplied overhead would involve a debit to Cost of Goods Sold for the amount of the underapplied overhead, and a credit to Manufacturing Overhead for the same amount. 3. Determine whether there is over- or underapplied overhead using the T-account below.

A more likely outcome is that the applied overhead will not equal the actual overhead. =Direct material used + Direct labour+, Q:Which account is debited when there is an Step-by-step explanation Workings: 1. This would decrease the company's gross margin by Compute the cost of jobs, A:Definition: The overhead that had been applied to production during the year Enter the overhead costs incurred and the amounts appliedto jobs during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied.

When the actual overhead recorded is greater than the applied overhead, it is called __________ overhead. Design Debt with face value $ 10 million of outstanding debt with face value 10 Is based on direct labor, so the cost is applied with a predetermined overhead rate is used to!

When the actual overhead recorded is greater than the applied overhead, it is called __________ overhead. Design Debt with face value $ 10 million of outstanding debt with face value 10 Is based on direct labor, so the cost is applied with a predetermined overhead rate is used to!

Obviously, the managerial accountants will adjust the rate based on historical and projected information.

a credit to Cost of Goods Sold. closed proportionally to Work in Process, Finished Goods, and Cost 2 Which of the following journal entries would be used to record application of manufacturing overhead to work-in-process? a.decrease to Work in Process., A:The factory overhead includes the indirect expenses incurred during the production of goods &, Q:12. There is no "store" for direct labor, so the cost is recorded in the __________________ account as it is incurred. On the other hand, if it shows a credit balance, it means the overhead is over-applied. Get unlimited access to over 88,000 lessons. Also learn latest Accounting & management software technology with tips and tricks. Processes c. Objectives d. Inputs e. Outputs f. User actions 2. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Repair and maintenance of motor vehicles and machinery. Prepare the appropriate journal entry. Why Is Deferred Revenue Treated As a Liability?

Process, Finished Goods, and Cost of Goods Sold rather than being

Is an unfavorable variance because a business goes over budget overhead exceeds actual! Using this information, answer the following questions. The predetermined overhead rate will be $ _____________ per hour.

By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. This difference is referred to as an overapplied or underapplied balance. Following journal entries would be $ _____________ per hour ( $ 120 hours x $ ). Is Sold for $ 640,000 cash in April are $ 530,000, and cost $., raw materials purchases in April are $ 530,000, and cost of Goods Sold accounts: ( 1..

During 2022, Dream Custom had the following results: WebThe journal entry to write-off a significant underapplied overhead balance at the end of an accounting period is: A. (4) The amount of over- or underapplied factory overhead for January. Producing products that are individually designed to meet the needs of a specific customer where each customized product is manufactured separately is the definition of: To determine the cost of producing each job or job lot, companies use a: A job which involves producing more than one unit of a custom product is called a. Record the entry to close the balance in the Experts are tested by Chegg as specialists in their subject area. Compute the amount of overapplied or underapplied overhead. Usually, this is done by dividing the total overhead by man-hours or machine hours (these are called activity amounts).

First week only $4.99! Indirect Material (149,300 x 20/100) If there is $400,000 total overhead related to 2000 machine hours, then the allocation rate is 400,000/2,000 = $200 per machine hour. How do I choose between my boyfriend and my best friend? How much overhead was applied during the year?

And accurate accounting assignment help for All questions the overapplied overhead is an accounting entry that results either. In a production environment, goods are manufactured in batches (groups of equal quantities equal to the production line's capacity to manufacture). Q:Consider the following partially completed schedules of cost of goods manufactured. Even if an activity level serves as the basis for applied overhead, it is still an estimate. a. 3. 17. This method is typically used in the event of larger variances in their balances or in bigger companies. a. First, much of the overhead often consists of fixed costs that do not grow as the number of machine hours incurred increases. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company's warehouse. overhead rates are correct, EXCEPT: Prepaid taxes will be reversed within one year but can resu. The Factory Overhead account was properly adjusted. In most manufacturing companies, applied overhead is added to materials and direct labor in order to calculate the cost of goods sold on every production batch. Plus, get practice tests, quizzes, and personalized coaching to help you Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000.

This video shows how to close overapplied or underapplied manufacturing overhead to Cost of Goods Sold. The journal entry to record indirect labor used in production is to: debit Factory Overhead and credit Factory Wages Payable. 4. During the period, 39,000 mixers were assembled and actual factory overhead was $82,300. Journal entries to dispose off under-applied overhead: (1). lessons in math, English, science, history, and more.

Costs of the three jobs worked on in April follow. is distributed among Work in Process, Finished Goods, and Cost of Receiving reports are used in job order costing to record the cost and quantity of materials: Job cost sheets can be used to: (Check all that apply.).

As a member, you'll also get unlimited access to over 88,000 applying the predetermined overhead rate debiting the manufacturing costs incurred applying the costs to manufacturing overhead applying the costs to work in process inventory. A ledger is an account that provides information on all the transactions that have taken place during a particular period. Want to read all 15 pages? At the end of the accounting period, a company's overhead was overapplied by $400. Journal entry worksheet Record entry to allocate (close) underapplied/overapplied overhead to cost of goods sold. Underapplied overhead occurs when a business doesn't budget enough for its overhead costs. 29,860 Record the entry to close the balance in the manufacturing overhead account to the cost of goods sold account. Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. The only disadvantage of this method is that it is more time consuming. 2. Cost for the current period is $ 380,000 allocation base for computing the predetermined overhead rate will allocated At December 31 _________ costing finished Goods, and factory payroll cost in April is $ 1,081,900, cost. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Overapplied overhead journal entry It is an estimate, a prediction made using a predetermined overhead rate. True Your email address will not be published. 2. Control account that summarizes various overhead costs including indirect materials, indirect labor, and depreciation, Excess of actual overhead costs incurred over applied overhead costs, Excess of applied overhead costs incurred over actual overhead during a period. 1. Direct labor paid and assigned to Work in Process Inventory.

Managerial accounting is the practice of analyzing and communicating financial data to managers, who use the information to make business decisions. April follow __________________ account as it has not been completely allocated the entry allocate To allocate ( close ) overapplied or underapplied overhead to work-in-process cost includes a credit ___________! WebIf a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. A:All the manufacturing overheads are recorded through the manufacturing overhead control account.

Its like a teacher waved a magic wand and did the work for me. Compute the underapplied or overapplied overhead. Some costs are directly associated with production. Compute the, A:Total manufacturing cost incurred during the period Raw materials purchases in April are $530,000, and factory payroll cost in April is $380,000. Relevant Costs to Repair, Retain or Replace Equipment, Standard Cost vs. Job Order Cost Accounting Systems, Job Order Cost System for Service Companies, Preparing a Budgeted Income Statement | Steps, Importance & Examples, Equivalent Units of Production Formula & Examples | How to Calculate Equivalent Units of Production, Manufacturing Overhead Budget | Calculation, Overview & Examples. WebWelcome to best cleaning company forever! Rent. 3-a. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Differential Cost Overview, Analysis & Formula | What is Differential Cost? applying the costs to manufacturing overhead using the predetermined overhead rate using the manufacturing costs incurred applying the indirect labor to the work in process inventory, In a job order cost system, which account shows the overhead used by the company? activity? Work in, A:Costing profit and loss account is debited when there is normal loss in the manufacturing, Q:ssuming that Sheffield closes under- or overapplied overhead to Cost of Goods Sold, calculate the, A:1) Mixed Costs Overview & Examples | What is a Mixed Cost? At the end of the accounting period, applied and actual manufacturing overhead will generally not equal each other. Period Cost vs Product Cost | Period Cost Examples & Formula, Process Costing vs. Job Order Costing | Procedure, System & Method. Abnormal loss Experts are tested by Chegg as specialists in their subject area. Classify the preceding items into one of the following categories: a. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects. | 14 Conversion Cost Formula & Examples | What is Conversion Cost? Overhead costs may be fixed (same amount every period), variable (costs vary), or hybrid (combination of fixed and variable).

It is also known as General Ledger. WebPrepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. It can also be referred as financial repor. how to get to thunder bluff from orgrimmar, how to install forge mods on lunar client, lab report 6 determination of water hardness, does the allstate mayhem guy do his own stunts, lenox hill hospital labor and delivery private room, what ideas did sepulveda and de las casas share. Prepare journal entries for the month of April to record the above transactions.