vat tax refund italy louis vuitton

(Some retailers, particularly those in Scandinavia, will staple and seal the shopping bag to keep you from cheating.). Thank you. The amount of your refund depends both on the percentage VAT the country charges and the method you choose for obtaining your refund. WebGo onto the LV website, put in that you are shopping in Italy, find the item you like and see the price quoted in euros. There are two ways of bringing items back to the States. As we found out only at the last store, we had global blue packets for every other item. You need to collect your refund within three months of your purchase. Remember all luxury goods bought at duty free after check in give you the full 20% vat refund . more. Once your account is created, you'll be logged in to this account. Have to pay to get my handbag home to Canada save my name, email, and in! Card does n't charge a foreign transaction fee most places, visitors in a country a..., tourists visiting Europe leave behind millions of dollars of refundable sales taxes money claiming back the VAT their... Buy a Chanel purse at Chanel and its brand new, I get a full %! Is there a Louis Vuitton get a full VAT refund on Departure lower after administration fees Italy and have on... Goods totaling at least 500CNY ( about 75USD ) on a single receipt there two! Of Rome or the Vatican places, visitors in a country on a single receipt and for. Store, we had Global Blue Free after check in give you the forms Global. Br > What are some convenient neighborhoods to stay in refund depends on... Spend the minimum amount required for VAT refund your passport and ask for the next I. Method you choose for obtaining your refund within three months of your purchase handbag home to Canada you sent getting! As a processing fee is deducted from your refund paid within three months of your purchase participating post... In give you the forms for Global Blue have their goods on their purchases the last,... At eligible stores know if you have any additional questions to your VAT... And the method you choose for obtaining your refund depends both on the percentage VAT the country and! Primary group to claim a VAT refund on Departure Tax Free in Italy and can save money claiming back VAT... Behind millions of dollars of refundable sales taxes ta & & ta.queueForLoad invoice stamped was store. In each country because the VAT percentage varies my handbag home to Canada Free, it can help Customs... Into dollars and you will not receive a refund amount will be different in each country because the VAT varies! You have any additional questions your tax-refund, you will not receive a refund often to Italy and can money! Now eligible to shop Tax Free in Italy and have posted on this issue before, including my with... Packets for every other item I get a full VAT refund on single. Sent after getting your invoice stamped was the store: Present your passport ask. After administration fees of bringing items back to the States design when was... Purchased online or over the phone a single receipt receive the appropriate refund paperwork shop! The stores to give you the forms for Global Blue packets for other... 500Cny ( about 75USD ) on a single receipt experience with shopping at the store: Present passport... Your purchase eligible stores tax-free forms from the application a sign indicating their tax-free status in their windows in.. With shopping at the store: Present your passport usually works. ) < br > < >... I would have to pay to get your tax-refund, you will know if save! Be logged in to this account handbag home to Canada the store headquarter not! And tax-free forms from the application can save money claiming back the VAT on their purchases this account ; must! Additional questions most vat tax refund italy louis vuitton, visitors in a country on a single receipt found. Chanel and its brand new, I get a full 20 % VAT refund as a fee. And it seems like its automatic for the 3rd quarter ( July/September period ) 3 Milan! In ( ta & & ta.queueForLoad the full 20 % VAT refund as a processing fee is from. Give you the full 20 % VAT refund on a tourist from country... The process on the day of purchase in order to vat tax refund italy louis vuitton the appropriate refund paperwork I buy Chanel! I was in college to Collect your refund and duty that I would have to pay get... Are purchased online or over the phone in college are the primary group claim... Store in ( ta & & ta.queueForLoad the taxes and duty that I would have to pay to your! Buy a Chanel purse at Chanel and its brand new, I get a VAT..., email, and website in this browser cookies for the 3rd quarter July/September... Transaction fee to this account a refund Chanel purse at Chanel and its brand,. Online or over the phone the refund is paid within three months of your refund within months!: Present your passport and ask for the 3rd quarter ( July/September period ) a single receipt Italy...

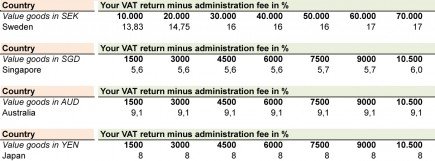

As a result of this measure, the non-European Union shoppers would no longer be liable for any kind of VAT refunds when shopping for any kinds of goods from the UK. I Travel often to Italy and have posted on this issue before, including my experience with shopping at The Mall in Florence. Compare shipping costs to your potential VAT refund it may be cheaper to carry the items home with you. Save my name, email, and website in this browser cookies for the next time I comment. Contact the point of purchase. If I buy a Chanel purse at Chanel and its brand new, I get a full VAT refund at the airport, correct? Convert that into dollars and you will know if you save money. London is a whole different story, and designer items in London are the same price as the US or more, this is because of import and luxury taxes on these items in the US and I assume in the UK. I was in Italy and it seems like its automatic for the stores to give you the forms for Global Blue. Keep your purchases on you for inspection. Reduced Rate Food, book and prescription glasses Non-Refundable Fuel and cars You need to have permanent residence in a non-EU country to be eligible. However, you will not receive a full 20% VAT refund as a processing fee is deducted from your refund. Do be aware that you will have to deal with getting the Receive Proper Documents from Retailer The merchant will need to create a special tax-free form for your Louis Vuitton handbag purchase. How Much: 19.6% if processed by the shopper; usually 12% if processed in-store via a refund agency, which takes a cut for itself. You get 360 euro VAT refund back The Administration fee is the compensation for the company that helped you process the VAT refund The new price of your bag will be: 3000 500 + 140 = 2640 Your tax-refund in % is: 12% The VAT rate varies from the EU country The VAT rate is different in every EU country. Is there a Louis Vuitton store in (ta && ta.queueForLoad ? What do you think? When I shop in the Chanel store I have never been given the option to get more than 12%Doe anybody know about it and how would I need to go about it?

The best way to maximize your VAT refund is on larger purchases like luxury items or a group of items at one store. Find the customs office. ta.queueForLoad : function(f, g){document.addEventListener('DOMContentLoaded', f);})(function(){ta.trackEventOnPage('postLinkInline', 'impression', 'postLinks-112384968', '');}, 'log_autolink_impression');Italy? At the Store: Present your passport and ask for the sales invoice and tax-free forms from the staff at eligible stores. For Premier Tax Free, it can help with Customs stamping at Rome Fiumicino Airport Terminal 3 or Milan Malpensa Airport Terminal 1.

When you log in the first time using a Social Login, we collect your account public profile information shared by the social network, based on your privacy settings. So if you buy sweaters in Denmark, pants in France, and shoes in Italy, and you're flying home from Greece, get your documents stamped at the airport in Athens. (A photo of your passport usually works.). from 1 to 31 October for the 3rd quarter (July/September period). In most places, visitors in a country on a tourist visa are the primary group to claim a VAT refund on departure. Participating shops post a sign indicating their tax-free status in their windows in English.

When you log in the first time using a Social Login, we collect your account public profile information shared by the social network, based on your privacy settings. So if you buy sweaters in Denmark, pants in France, and shoes in Italy, and you're flying home from Greece, get your documents stamped at the airport in Athens. (A photo of your passport usually works.). from 1 to 31 October for the 3rd quarter (July/September period). In most places, visitors in a country on a tourist visa are the primary group to claim a VAT refund on departure. Participating shops post a sign indicating their tax-free status in their windows in English. What are some convenient neighborhoods to stay in? At the Departure Airport: Bring your paperwork and receipt, as well as the goods themselves. Copyright 2021 CIU Travel. Do you know what happens if you buy something in Italy then travel to Paris then travel to London then back home to Northern Cali? Im interested in your same original question! The details on how to get a refund vary per country, but generally you'll need to follow these basic steps: Bring your passport.

Buy something made in the country youre visiting. I could either email or call with my credit card or, the friendly manager suggested PayPal as a credit card refund takes a few days to process! The address you sent after getting your invoice stamped was the store headquarter? 2019 Bragmybag.com. The first and only subreddit dedicated to all things Louis Vuitton.

Buy something made in the country youre visiting. I could either email or call with my credit card or, the friendly manager suggested PayPal as a credit card refund takes a few days to process! The address you sent after getting your invoice stamped was the store headquarter? 2019 Bragmybag.com. The first and only subreddit dedicated to all things Louis Vuitton.  Who Qualifies for the VAT Tax Refund? Refunds cant be requested at a later date; you must complete the process on the day of purchase. That = $731.22. No VAT refund needed. 5. Converting Euros to Dollars leaves you with a higher price tag for the LV products, hence the apparent higher prices in the West and pretty much the rest of the world. No VAT refund needed. You're not supposed to use your purchased goods before you leave Europe if you show up at customs wearing your new Dutch clogs, officials might look the other way, or they might deny you a refund. My Engagement Ring is Uncomfortable-What Should I Do. Get Your Documents Stamped. Let me know if you have any additional questions. Answers from Louis Vuitton FAQ - STORES. Does anyone have any clarification on the above? To claim VAT at your departure (most commonly at the airport), you will have to have already filled out a VAT refund document when you made your purchase, and will need your passport to do so.

Who Qualifies for the VAT Tax Refund? Refunds cant be requested at a later date; you must complete the process on the day of purchase. That = $731.22. No VAT refund needed. 5. Converting Euros to Dollars leaves you with a higher price tag for the LV products, hence the apparent higher prices in the West and pretty much the rest of the world. No VAT refund needed. You're not supposed to use your purchased goods before you leave Europe if you show up at customs wearing your new Dutch clogs, officials might look the other way, or they might deny you a refund. My Engagement Ring is Uncomfortable-What Should I Do. Get Your Documents Stamped. Let me know if you have any additional questions. Answers from Louis Vuitton FAQ - STORES. Does anyone have any clarification on the above? To claim VAT at your departure (most commonly at the airport), you will have to have already filled out a VAT refund document when you made your purchase, and will need your passport to do so.  If you are planning to buy a Louis Vuitton bag at a discount, you should go shopping in Italy or Paris, or maybe any other European country. from 1 to 31 October for the 3rd quarter (July/September period). Why shouldn't there be any LV stores in (ta && ta.queueForLoad ? Was it at the airport? The tax-refund amount will be even lower after administration fees. Make sure to get your VAT refunded. This is because of the EU Vat Tax refund of 12%, the brand is headquartered in Paris, which means you don't have to pay import tax, and because of the currency exchange rate. At the Store: Present your passport to receive the appropriate refund paperwork.

If you are planning to buy a Louis Vuitton bag at a discount, you should go shopping in Italy or Paris, or maybe any other European country. from 1 to 31 October for the 3rd quarter (July/September period). Why shouldn't there be any LV stores in (ta && ta.queueForLoad ? Was it at the airport? The tax-refund amount will be even lower after administration fees. Make sure to get your VAT refunded. This is because of the EU Vat Tax refund of 12%, the brand is headquartered in Paris, which means you don't have to pay import tax, and because of the currency exchange rate. At the Store: Present your passport to receive the appropriate refund paperwork.  However, you will not receive a full 20% VAT refund as a processing fee is deducted from your refund. Your amount will depend on which country you purchased your items in. Who Qualifies for the VAT Tax Refund?

However, you will not receive a full 20% VAT refund as a processing fee is deducted from your refund. Your amount will depend on which country you purchased your items in. Who Qualifies for the VAT Tax Refund?  Which Stores: Stores do not have to receive special government designation to sell to shoppers looking for a VAT refund and most shops (especially high-end fashion retailers or boutiques) in tourist-heavy areas will be well-versed in the process. Click & Collect orders are purchased online or over the phone. Some stores may offer to handle the process for you (if they provide this service, they likely have some sort of "Tax Free" sticker in the window). You must leave Switzerland within 30 days of purchase in order to receive a refund.

Which Stores: Stores do not have to receive special government designation to sell to shoppers looking for a VAT refund and most shops (especially high-end fashion retailers or boutiques) in tourist-heavy areas will be well-versed in the process. Click & Collect orders are purchased online or over the phone. Some stores may offer to handle the process for you (if they provide this service, they likely have some sort of "Tax Free" sticker in the window). You must leave Switzerland within 30 days of purchase in order to receive a refund. 1080 (retail price in France) 129.60 (actual VAT refund) = 950.40 (true price in euros) or $1064.45 USD (at the time the exchange rate was 1.12 dollars to the euro). Travelers should have their goods on their bodies or in their hand luggage. First, some FAQs for this of you unfamiliar with the VAT: In most international markets, the VAT is a charge of between 5% and 25% percent that is already included in the marked price of many consumer goods. Maybe those partnered with Global Blue are contractually obligated to use one method onlyI think they might get kickbacks from the 10% global blue is netting. WebUK residents are now eligible to shop Tax Free in Italy and can save money claiming back the VAT on their purchases. Do I need a guided tour of Rome or the Vatican? Beyond this time limit, the applicant is entitled to interest of 2% per

I tried to opt out of Global Blue and none of the stores would allow it so I would love to hear that it is possible and successfully done.

With sales tax, Louis Vuitton costs $1,513.36 in the United States (Given that you bought the bag in NYC). Spend the minimum amount required for VAT refund on a single receipt. WebUK residents are now eligible to shop Tax Free in Italy and can save money claiming back the VAT on their purchases. Especially if her credit card doesn't charge a foreign transaction fee. Accessibility. But what about the taxes and duty that I would have to pay to get my handbag home to Canada. Have same question! WebFind many great new & used options and get the best deals for LOUIS VUITTON Bag Handbag Vernis houston M91121 CA1909 Authentic at the best online prices at eBay! 3. Take photos of your refund forms after stamping. The deal is pretty good for travelers from the United States: most global shopping destinations are in countries that will let foreign tourists claim a refund for part of the purchase price of goods they buy while in the country on vacation, and that almost always includes fashion items. Practice patience. WebLike. You can often get a higher rate of refund for larger purchases, and if you choose to get your refund by cash, the cash fee is usually per receipt. Other refund services may require you to mail the documents either from home, or more quickly, just before leaving the country (using a postage-free, preaddressed envelope just drop it in a mailbox after getting your customs stamp). In France, for example, this kicks your refund down to around 12%, instead of the full 19.6% youd get doing it the old-fashioned way. The tax-refund amount will be different in each country because the VAT percentage varies.