Existing borrowers may be eligible for PPP loan forgiveness. SBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 18, 2021 OMB Control No. 660 0 obj <>/Filter/FlateDecode/ID[<90F4A44E0BF9E2488D33C67C7CE841B2><4EB99FAF88B3FD45B592BF831E3D3353>]/Index[628 62]/Info 627 0 R/Length 142/Prev 404840/Root 629 0 R/Size 690/Type/XRef/W[1 3 1]>>stream Allrightsreserved. If you have questions or would like to apply by phone or in-person with a business lending specialist, please schedule an appointment or call 866.543.2808 Monday Friday 8 a.m.10 p.m. SEK is proud to provide Guidance You Can Count On. alternatively, was in operation in all four quarters of 2019 and experienced a reduction in annual receipts of 25% or greater in 2020 compared to 2019 and the borrower submits copies of its annual tax forms substantiating the revenue decline. For all entities other than those satisfying the conditions set forth below, Applicants must demonstrate that gross receipts in any quarter of 2020 were at least 25% lower than the same quarter of 2019. In particular, for tax returns that include sales tax as income and then as a deduction, annotate next to the taxes and license line of the return the amount of such taxes that were included in income. Check One: Sole proprietor Partnership C -Corp S LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization Schedule C filers using the gross income test must apply for a First Draw PPP loan on the new.

WebApplicant acknowledges that if the Applicant is approved for an SVO grant before SBA issues a loan number for this loan, the Applicant is ineligible for the loan and acceptance The SBA and the US Treasury Department seized on the definition of payroll costs contained in the CARES Act, which provides, in relevant part, that any compensation to or income of a sole proprietor or independent contractor that is a wage, commission, income, net earnings from self-employment or similar compensation constitutes payroll costs to allow sole proprietors to receive the larger PPP loans by using their gross income (maximum $100,000) instead of net profit. Complete the form below, and the team member best suited to help you will be in touch soon.

These ads are based on your specific account relationships with us. Question Yes No 1. The interim final rule, titled Business Loan Program Temporary Changes; Paycheck Protection Program Revisions to Loan Amount Calculation and Eligibility, revises the maximum loan calculations for sole proprietors who file Schedule C returns, but the change is not retroactive. OMB Control No. Alternatively, Applicants may compare annual gross receipts in 2020 with annual gross receipts in 2019; Applicants choosing to use annual gross receipts must enter Annual in the 2020 Quarter and Reference Quarter fields and, as required documentation, must submit copies of annual tax forms substantiating the annual gross receipts reduction. WebSBA Form 2483 - Addendum A - Complete Multiple If Necessary Affiliate Business Legal Name: State of Organization: EIN: Affiliate Business Address: (Street, City, State, Zip) NAICS Code: Affiliate Business # of employees: Affiliate Business Legal Name: State of Copyright 2023 McCarter & English, LLP. On March 12, 2021, the SBA updated the Frequently Asked Questions (FAQs) and updated the documents on how to calculate maximum loan amounts. Please also note that employee compensation and owner replacement compensation must be prorated for the Covered Period.

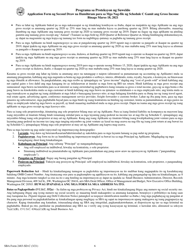

: 3245-0417 Expiration Date: 7/31/2021 Check One: Sole proprietor Partnership C-Corp S-Corp LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization WebSBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income March 3, 2021 . In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. For detailed information on the Paycheck Protection Program visit the SBA website. We cannot serve as your lawyers until we establish an attorney-client relationship, which can occur only after we follow procedures within our firm and after we agree to the terms of the representation. WebApplicant acknowledges that if the Applicant is approved for an SVO grant before SBA issues a loan number for this loan, the Applicant is ineligible for the loan and acceptance New PPP first-draw (Form 2483-C) and second-draw (Form 2483-SD-C) borrower application forms for Schedule C filers using gross income. Lenders have the following options to assist Schedule C filers who wish to use the gross income methodology to calculate PPP loan amounts but have already submitted PPP loan applications. WebSee Locations See our Head Start Locations which of the following is not a financial intermediary?  Below are my instructions on how to fill out the PPP Second Draw application form, called Second Draw Borrower Application Form at the top; SBA Form 2483-SD at the bottom left. : 3245-0417 Expiration Date: The following entities are exempt from the affiliations rules: The following entities are not eligible for a Second Draw PPP Loan: Note: in FAQs 57 and 58, the SBA clarified (a) lobbying activities is as defined in section 3 of the Lobbying Disclosure Act ( 2 U.S.C. Are there other business owners with 25% or more equity? Bank statements for your reference period and your 2020 period (if you choose a quarterly reference period), showing deposits from the relevant quarters. dwC9JH}Jn$ =>9j}zQ}/i]{sorQ8=@+6h:GZ9. Business Address/NAICS Code/Business Phone/Primary Contact/E-mail Address: Enter the same information as

Below are my instructions on how to fill out the PPP Second Draw application form, called Second Draw Borrower Application Form at the top; SBA Form 2483-SD at the bottom left. : 3245-0417 Expiration Date: The following entities are exempt from the affiliations rules: The following entities are not eligible for a Second Draw PPP Loan: Note: in FAQs 57 and 58, the SBA clarified (a) lobbying activities is as defined in section 3 of the Lobbying Disclosure Act ( 2 U.S.C. Are there other business owners with 25% or more equity? Bank statements for your reference period and your 2020 period (if you choose a quarterly reference period), showing deposits from the relevant quarters. dwC9JH}Jn$ =>9j}zQ}/i]{sorQ8=@+6h:GZ9. Business Address/NAICS Code/Business Phone/Primary Contact/E-mail Address: Enter the same information as  It is a business concern, independent contractor, eligible self-employed individual, sole proprietor, nonprofit organization eligible for a First Draw PPP Loan, veterans organization, Tribal business concern, housing cooperative, small agricultural cooperative, eligible 501(c)(6) organization or destination marketing organization, eligible nonprofit news organization, additional covered nonprofit entity, or eligible Internet publishing company;Please note that the Economic Aid Act added housing cooperatives, eligible 501(c)(6) organizations or destination marketing organizations, and eligible nonprofit news organizations to the businesses that are eligible for First Draw PPP Loans. If you opt out, though, you may still receive generic advertising. To apply for a Paycheck Protection Program Loan through Bank of America at this time, you must have an existing Small Business relationship with one of the following: Review the PPP Document Reference Sheet for information on supporting payroll and/or tax information requirements.

It is a business concern, independent contractor, eligible self-employed individual, sole proprietor, nonprofit organization eligible for a First Draw PPP Loan, veterans organization, Tribal business concern, housing cooperative, small agricultural cooperative, eligible 501(c)(6) organization or destination marketing organization, eligible nonprofit news organization, additional covered nonprofit entity, or eligible Internet publishing company;Please note that the Economic Aid Act added housing cooperatives, eligible 501(c)(6) organizations or destination marketing organizations, and eligible nonprofit news organizations to the businesses that are eligible for First Draw PPP Loans. If you opt out, though, you may still receive generic advertising. To apply for a Paycheck Protection Program Loan through Bank of America at this time, you must have an existing Small Business relationship with one of the following: Review the PPP Document Reference Sheet for information on supporting payroll and/or tax information requirements.

On May 4, 2021, the SBA announced it would stop accepting new applications. Subscribe. Is the franchise listed in SBAs Franchise Directory? You have indicated that the Applicant files taxes using IRS Form 1040, Schedule C and that you want to use gross income to calculate your Requested Loan Amount. The review will assess whether these borrowers complied with the PPP eligibility criteria, including the good faith loan necessity certification. On March 3, 2021, the SBA posted: (a) a revised Borrower Application Form and a revised Second Draw Borrower Application Form; (b) Borrower Application for Schedule C Filers Using Gross Income; (c) Second Draw Borrower Application Form for Schedule C Filers using Gross Income; (d) revised lender application form and a revised For for-profit businesses, the SBA clarified net capital gains and losses are excluded and that the terms carry the definitions used and reported on IRS tax forms. If a Schedule C filer has employees, the borrower may elect to calculate the owner compensation share of its payroll costs based on either net profit or gross income minus expenses reported on lines 14 (employee benefit programs), 19 (pension and profit-sharing plans), and 26 (wages (less employment credits)) of Schedule C. If a Schedule C filer has no employees, the borrower may simply choose to calculate its loan amount based on either net profit or gross income. Refer to the Small Business Administration and U.S. Treasury Website on Assistance for Small Businesses to review all the terms and conditions. On March 11, 2021, the American Rescue Plan Act of 2021 (the ARP Act) was enacted and certain eligibility changes were made to the Second Draw PPP Loan program and an additional $7.25 billion was added for PPP Loans. Last year, self-employed individuals who conducted their business without any employees could qualify for a Paycheck Protection Program (PPP) loan in an amount equal to approximately 20.8% (2.5 months divided by 12 months) of their 2019 annual net earnings from self-employment not to exceed $100,000, or no greater than $20,833 (20.8% of $100,000 capped). It has used, or will use, the full amount of the First Draw PPP Loan (including the amount of any increase on such First Draw PPP Loan) on authorized uses under the PPP rules on or before the expected date on which the Second Draw PPP Loan is disbursed to the borrower. If you prefer that we do not use this information, you may opt out of online behavioral advertising. LLC.

Here are the basic documents everyone should keep in mind. Gross receipts includes all revenue in whatever form received or accrued (in accordance with the entitys accounting method, i.e., accrual or cash) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances but excluding net capital gains or losses (as these terms carry the definition used and reported on IRS tax return forms). Note: Any of the following included in the specific tax form lines must be excluded from the computation and annotated on the return: taxes collected for and remitted to a taxing authority if included in gross or total income (such as sales or other taxes collected from customers and excluding taxes levied on the concern or its employees); proceeds from transactions between a concern and its domestic or foreign affiliates; and amounts collected for another by a travel agent, real estate agent, advertising agent, conference management service provider, freight forwarder, or customs broker. WebSBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME (Note: See Item 3 Bankruptcy for meaning of presently involved in any bankruptcy.). Proprietor expenses equal the difference between the Borrowers gross income and employee payroll costs. The SBA will review a sample of the population of first draw PPP loans made to Schedule C filers using the gross income calculation if the gross income on the Schedule C used to calculated the borrowers loan amount exceeds the $150,000 threshold. %PDF-1.6

%

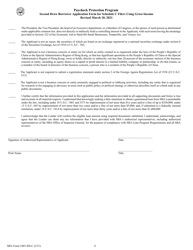

The purpose of this Affiliation Worksheet is to collect information from a borrower that answered YES to Question 3 on its Paycheck Protection Program (PPP) Loan Application (SBA Form 2483, SBA Form 2483-C, SBA Form 2483-SD, SBA Form 2483-SD-C, or lenders equivalent) or a borrower for which information available to the  SBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income March 3, Call us if you need to speak to a representative.866.457.4892Monday-Friday: 7 a.m.-11 p.m. ETSaturday: 8 a.m.-8 p.m. ETSunday: Closed. WebLoans and SBA Form 2483-SD or SBA Form 2483-SD-C for Second Draw PPP Loans). Generally, receipts are considered total income (or in the case of a sole proprietorship, independent contractor, or self-employed individual gross income) plus cost of goods sold, and excludes net capital gains or losses as these terms are defined and reported on IRS tax return forms. As of December 21, 2020 have a Merrill Lynch Working Capital Management Account (WCMA), Endowment Management Account (EMA), or Business Investing Account (BIA) and have either (i) a business credit relationship with Bank of America or (ii) do not have a business credit or borrowing relationship with another bank. Since the calculation of net earnings for self-employment is conducted after deductions for fixed and other business expenses that a small business must cover to stay afloat, annual net earnings from self-employment can often be a very small number resulting in an extremely small PPP loan amount. Both rules take effect immediately. (normalerweise Form 941) und ii. Paycheck Protection Program : Second Draw Borrower Application Form for Schedule C Filers Using Gross Income Revised March 18, 2021 : The President, the Vice President, the head of an Executiv e department, or a Member of Congress, or the spouse of such person as determined :

SBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income March 3, Call us if you need to speak to a representative.866.457.4892Monday-Friday: 7 a.m.-11 p.m. ETSaturday: 8 a.m.-8 p.m. ETSunday: Closed. WebLoans and SBA Form 2483-SD or SBA Form 2483-SD-C for Second Draw PPP Loans). Generally, receipts are considered total income (or in the case of a sole proprietorship, independent contractor, or self-employed individual gross income) plus cost of goods sold, and excludes net capital gains or losses as these terms are defined and reported on IRS tax return forms. As of December 21, 2020 have a Merrill Lynch Working Capital Management Account (WCMA), Endowment Management Account (EMA), or Business Investing Account (BIA) and have either (i) a business credit relationship with Bank of America or (ii) do not have a business credit or borrowing relationship with another bank. Since the calculation of net earnings for self-employment is conducted after deductions for fixed and other business expenses that a small business must cover to stay afloat, annual net earnings from self-employment can often be a very small number resulting in an extremely small PPP loan amount. Both rules take effect immediately. (normalerweise Form 941) und ii. Paycheck Protection Program : Second Draw Borrower Application Form for Schedule C Filers Using Gross Income Revised March 18, 2021 : The President, the Vice President, the head of an Executiv e department, or a Member of Congress, or the spouse of such person as determined :